Ga check calculator

INSTRUCTIONS Enter last menstrual period LMP current. This tax is based on the value of the vehicle.

Georgia Paycheck Calculator Smartasset

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia.

. Free salary hourly and more paycheck calculators. Simply enter their federal and state W-4 information as. The tax must be paid at the.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Georgia Child Support Commission. Well do the math for youall you need to do is enter.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Pregnancy Due Dates Calculator Calculates pregnancy dates forward from last period or backward from due date. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia.

Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

This number is the gross pay per pay period. The Georgia Child Support Calculator has been developed and made available by the Georgia Commission on Child Support as the official calculator for. The primary step is to figure out how much youll be paid as an employee or how much youll have to pay as an employer.

Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator. Just enter the wages tax withholdings and. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Next divide this number from the annual salary. Subtract any deductions and. Supports hourly salary income and multiple pay frequencies.

As a result weve Online Paystub generator Georgia which created a. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. This Georgia bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Figure out your filing status work out your adjusted gross income.

Georgia Income Tax Calculator Smartasset

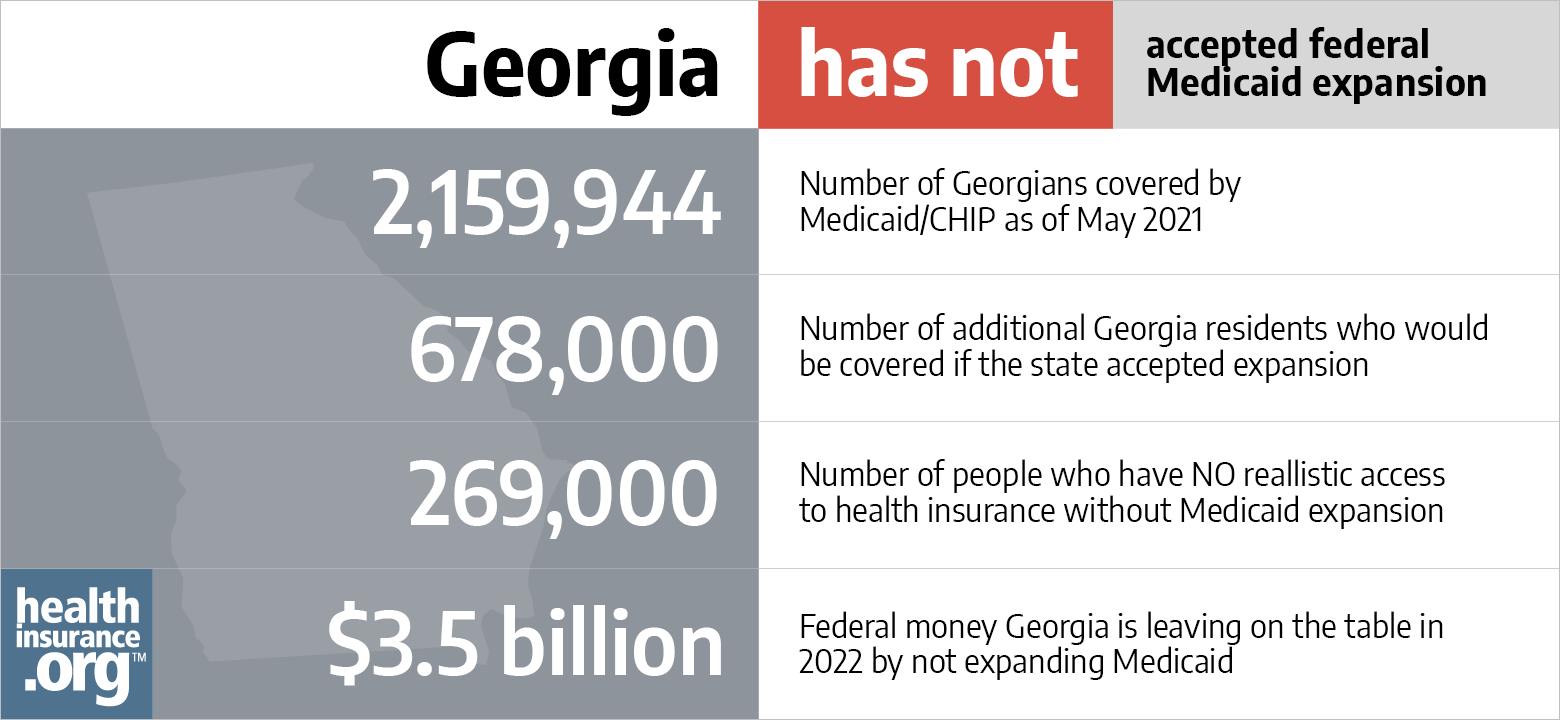

Aca Medicaid Expansion In Georgia Updated 2022 Guide Healthinsurance Org

2021 Health Insurance Marketplace Calculator Kff

Bonus Calculator Percentage Method Primepay

Paycheck Tax Withholding Calculator For W 4 Tax Planning

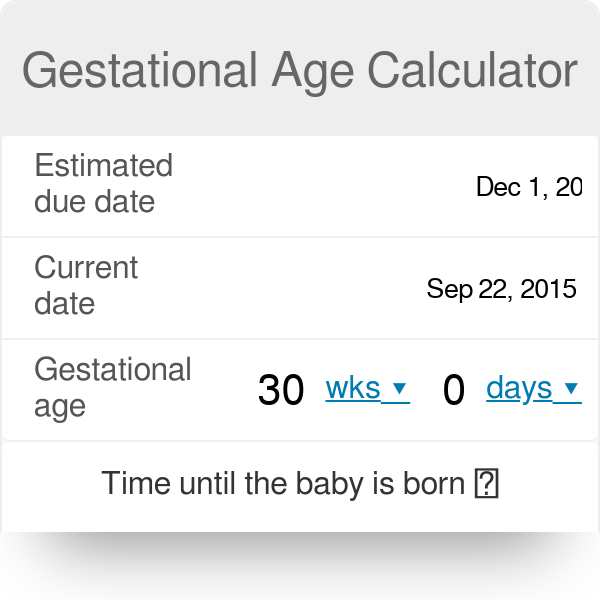

Gestational Age Calculator

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

Payroll Tax Calculator For Employers Gusto

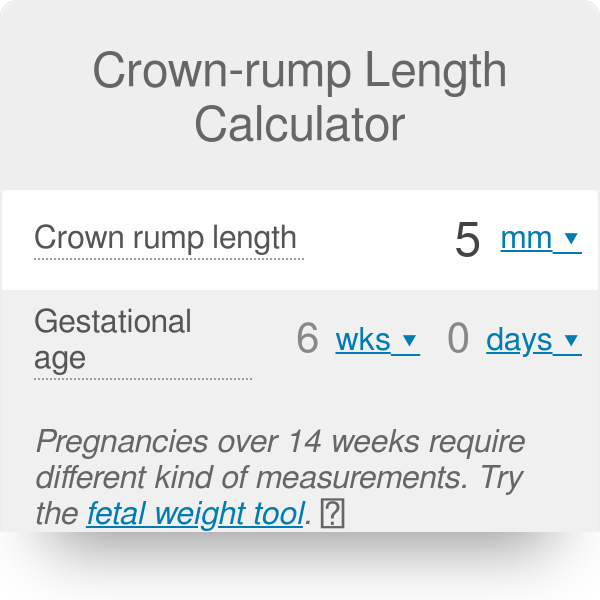

Crown Rump Length Calculator Crl

How To Calculate Child Support In Georgia 2018 How Much Payments

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Quarterly Tax Calculator Calculate Estimated Taxes

Paycheck Tax Withholding Calculator For W 4 Tax Planning

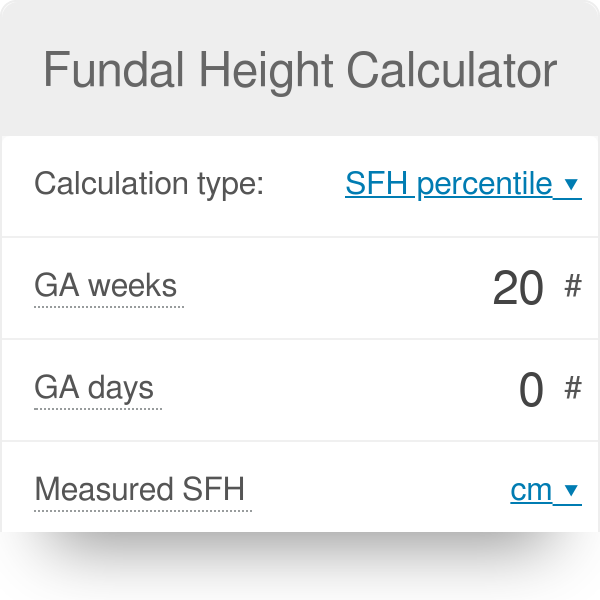

Fundal Height Calculator With Charts

Sales Tax Calculator