Activity based depreciation calculator

Here are the steps for the double declining balance method. Activity-based costing allocates overhead costs.

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Then you multiply this unit cost rate.

. Depreciation expense per hour 220000-200005000hours 40 per hour Depreciation expense for first year 40 1500 hours. There are four main methods to account for depreciation. The formula to calculate the depreciation for the units-of-production method.

Please calculate the depreciation for the first year. Costactual production during the year. The depreciation rate stays the same throughout the life of the asset used in this calculator.

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Divide 100 by the number of years in your assets useful life. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Straight-Line Depreciation Percent 100 Useful Life Depreciation Rate 2 x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning. Accumulated Depreciation is calculated using the formula given below Accumulated Depreciation Cost of Asset Salvage Value Life of the Asset Noof years For 2nd Year Accumulated. First you divide the assets cost basisless any salvage valueby the total number of units the asset is expected to produce over its estimated useful life.

The straight line calculation as the name suggests is a straight line drop in asset value. Depreciation expenses 50000 250000 12500 2500 Activity method is excellent in matching expense with revenue in situations where service efficiency of. The depreciation of an asset is spread evenly across the life.

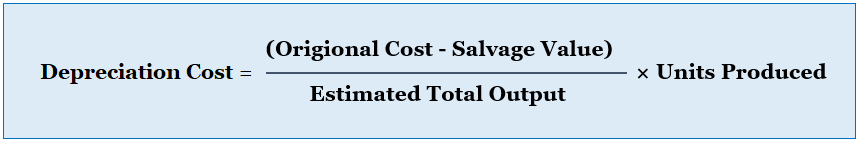

Units of Production Depreciation Asset cost - Salvage value Units units X Units produced Calculating unit of production depreciation manually can be hectic and time consuming. The formula to calculate an activity-based depreciation rate is. The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or.

Multiply the value you get by 2. This activity-based costing calculator template is a great tool to break-down overhead costs through activity-based costing. It provides a couple different methods of depreciation.

The quotient you get is the SLD rate.

Depreciation Schedule Formula And Calculator Excel Template

This Balance Sheet Template Allows Year Over Year Comparison Including Accumulated Depreciation Balance Sheet Template Balance Sheet Cash Flow Statement

03x Table 10 Cash Flow Statement Financial Statement Analysis Personal Financial Statement

1 Dansko Women S Phylicia Grey Waterproof Sneaker Klogzilla In 2021 Cute Gym Outfits Waterproof Sneakers Walking Shoes Women

Depreciation Schedule Formula And Calculator Excel Template

Balance Sheet Current Year Calculator Use The Balance Sheet Calculator To Calculate Your Balance Shee Spreadsheet Template Balance Sheet Template Spreadsheet

Depreciation Schedule Formula And Calculator Excel Template

Unit Of Production Depreciation Method Formula Examples

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Inventories Office Com List Template Free Business Card Templates Business Template

Straight Line Depreciation Formula And Calculation Excel Template

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Exponential Functions Ti Nspire Car Depreciation Project

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance